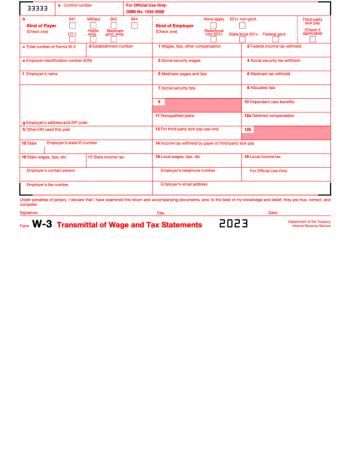

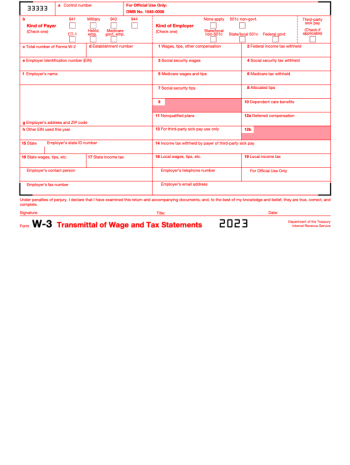

IRS Form W-3

Get NowIRS W-3 Form: Everything You Need to Know

When it comes to handling your taxes, understanding various tax forms can be quite complex. One such piece of paperwork is the W-3 Form, transmitted by your employer to the Internal Revenue Service (IRS). Simply put, it's an essential document that summarizes all the W-2 forms that an employer sends to their employees. The form reveals valuable information about the total earnings paid to employees, including withholdings for state, federal, and Social Security taxes. In this article, we are about to reveal all the essential details you must know before filing the W-3 form to the IRS or SSA.

Changes in IRS Form W-3 to Consider

The IRS periodically updates tax forms to reflect changes or modifications in tax law. For the tax year 2022, it is vital to note certain changes in IRS Form W-3 to maintain accuracy and avoid any trouble with the IRS. While the core purpose and structure of the form remain unchanged, some specific sections may be modified, such as deadlines or the format of certain boxes. These alterations mainly aim to improve the clarity of the 2022 IRS Form W-3 instructions, making it easier for individuals and businesses to comply with their tax reporting obligations accurately.

Who Needs IRS W-3 Form in 2023?

Determining whether or not you need to fill out an IRS W-3 form in 2023 largely depends on whether you fall under the category of an employer or business.

- Employers who pay out wages, tips, other compensation, and nonqualified deferred compensation to their employees need to fill out this form.

- However, if you are an employee or an independent contractor, you're likely not required to handle this form – your employer or hiring company should take care of it.

Maximizing Benefits with IRS W-3 Fillable Form

Completion of the IRS W-3 fillable form isn't just a federal requirement; it can indeed yield benefits when utilized correctly. It provides a secure and clear record of total compensation paid and taxes withheld for the year, which could assist in budget forecasting for the next year. Moreover, if you ever face a dispute with an employee about paid wages or deducted taxes, this form would serve as a solid piece of evidence.

Ensuring Accuracy with the W3 Tax Form

Providing accurate information is crucial to avoid potential penalties when submitting the W3 tax form with the IRS, ensure accurate tax reporting, and maintain proper payroll records. Familiarize yourself with the boxes each line requires, and ensure all totals align correctly with the corresponding W-2 forms. If any confusion arises, don't hesitate to consult with a tax professional or seek advice on financial forums.

Related Forms

-

![image]() W-3 IRS Form W-3, also known as the Transmittal of Wage and Tax Statements, is a critical document utilized by employers across the United States. In essence, this report acts as a summary of all W-2 forms issued by an employer, encompassing vital aspects such as total compensation and withholding information for all employees during a particular tax year. Not every employer is required to file IRS tax form W-3, but if W-2 copies are issued to employees, the transmittal sample should typically accom... Fill Now

W-3 IRS Form W-3, also known as the Transmittal of Wage and Tax Statements, is a critical document utilized by employers across the United States. In essence, this report acts as a summary of all W-2 forms issued by an employer, encompassing vital aspects such as total compensation and withholding information for all employees during a particular tax year. Not every employer is required to file IRS tax form W-3, but if W-2 copies are issued to employees, the transmittal sample should typically accom... Fill Now -

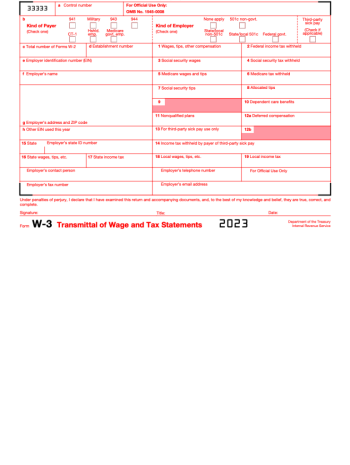

![image]() Form W-3 (PDF) The Internal Revenue Service provides different forms for businesses and individuals, enabling them to report their annual income accurately. One of such forms is Form W-3. Typically, it is used by employers to transmit wage and tax statements to the Social Security Administration. It acts as a wrap-up form for all the W-2 forms an employer has issued to its employees. To help you file your taxes correctly, it's essential to comprehend the structure and function of the Form W3 for 2022 in PDF format. The form comprises specific fields which need to be populated with accurate information. The most important fields include: Employer's name, address, and zip code Employer's Federal Identification Number Total number of Forms W-2 Total Medicare wages and tips Medicare tax withheld, and so on Filling Out the IRS W3 Form When filling out the 2022 W3 form in PDF, take note of these simplifying guidelines to ensure that no mistakes are made: Ensure the employer's personal details are accurate and complete All the monetary fields should be filled out in dollars, leaving out the cents The Total number of W-2 copies should match the number of employees in the company Guide to Filing Out Form W3 in 2023 Once your form is duly completed, the consequent step is filing. Considering IRS tax laws can be quite complex, a step-by-step guide can be extremely valuable: Before printing the Form W-3 PDF, ensure it's filled out correctly Print out the copy, ensuring high-quality print to maintain legibility In case of any errors, don’t attempt to correct them manually. Instead, print a new correct form Mail the completed form to the Social Security Administration together with Copy A of all the W-2 forms When Should You File Form W-3? The deadlines for filing taxes are designated by the IRS, and they often have severe penalties for late submissions or inaccuracies. Therefore, it's essential to be familiar with these deadlines. For most employers, the IRS W3 in PDF and W-2 forms are usually required to be filed by January 31st of the year following the tax year. However, deadlines may change, so it's advisable to constantly refer back to the Form W-3 instructions in PDF to stay updated. In a nutshell, understanding, completing, and filing Form W-3 on time is essential for every employer. Avoid any possible inaccuracies, and ensure that your employees receive their W-2 forms on time, which will, in turn, enable them to file their individual tax returns on time as well. Fill Now

Form W-3 (PDF) The Internal Revenue Service provides different forms for businesses and individuals, enabling them to report their annual income accurately. One of such forms is Form W-3. Typically, it is used by employers to transmit wage and tax statements to the Social Security Administration. It acts as a wrap-up form for all the W-2 forms an employer has issued to its employees. To help you file your taxes correctly, it's essential to comprehend the structure and function of the Form W3 for 2022 in PDF format. The form comprises specific fields which need to be populated with accurate information. The most important fields include: Employer's name, address, and zip code Employer's Federal Identification Number Total number of Forms W-2 Total Medicare wages and tips Medicare tax withheld, and so on Filling Out the IRS W3 Form When filling out the 2022 W3 form in PDF, take note of these simplifying guidelines to ensure that no mistakes are made: Ensure the employer's personal details are accurate and complete All the monetary fields should be filled out in dollars, leaving out the cents The Total number of W-2 copies should match the number of employees in the company Guide to Filing Out Form W3 in 2023 Once your form is duly completed, the consequent step is filing. Considering IRS tax laws can be quite complex, a step-by-step guide can be extremely valuable: Before printing the Form W-3 PDF, ensure it's filled out correctly Print out the copy, ensuring high-quality print to maintain legibility In case of any errors, don’t attempt to correct them manually. Instead, print a new correct form Mail the completed form to the Social Security Administration together with Copy A of all the W-2 forms When Should You File Form W-3? The deadlines for filing taxes are designated by the IRS, and they often have severe penalties for late submissions or inaccuracies. Therefore, it's essential to be familiar with these deadlines. For most employers, the IRS W3 in PDF and W-2 forms are usually required to be filed by January 31st of the year following the tax year. However, deadlines may change, so it's advisable to constantly refer back to the Form W-3 instructions in PDF to stay updated. In a nutshell, understanding, completing, and filing Form W-3 on time is essential for every employer. Avoid any possible inaccuracies, and ensure that your employees receive their W-2 forms on time, which will, in turn, enable them to file their individual tax returns on time as well. Fill Now -

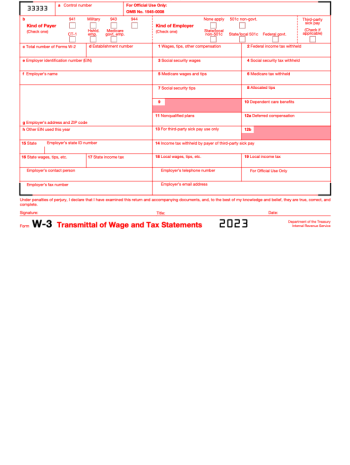

![image]() W-3 Transmittal Form When preparing your annual tax statements, there are a lot of documents employers have to deal with. For example, the W-3 transmittal of wage and tax statements is essential for every employer who extends Form W-2 to their employees. Let's delve into the practical aspects of this form, focusing particularly on various unusual circumstances, common mistakes, and FAQs. The W-3 Transmittal Form: Examples of Use In compliance with the IRS stipulations, a variety of situations and scenarios can necessitate the use of Form W-3 Transmittal. Putting it simply, if you're an employer and you have remunerated any employee during the year, the completion and submission of this form to the IRS become obligatory. Let's explore a few examples. Example 1: If you are an employer who employed a household worker such as a housekeeper, nanny, or gardener and compensated them over $2,300 during 2022, you are required to use this form Example 2: For small businesses that only utilize contract labor, remember that if this labor is under your control, similar to an employee, the IRS may classify this labor as an employee and not a contractor, requiring the use of the IRS W3 transmittal. Error Handling in Federal Form W-3 It's not uncommon for errors to occur during the submission process of Federal Form W-3 Transmittal. From minor numerical discrepancies to more serious infractions, such mistakes can cause significant delays in processing. Understanding how to correct these errors timely is pivotal. If, after the submission, an error is discovered on the Federal Form W-3 transmittal, make the necessary correction using Form W-2c, Corrected Wage and Tax Statement, and W-3c, Transmittal of Corrected Wage and Tax Statements. Do not complete a new W-3 form to correct an error. Popular W-3 Form-Related Questions Over my years of navigating legal and financial forums, I've encountered numerous questions on W-3 form transmittal. Here are three frequently asked questions. What is the due date for the W-3 transmittal form for 2022?The W-3 should be filed with the SSA by January 31, following the relevant calendar year. In which situations should an employer not file the IRS W3 transmittal?An employer who exclusively hires independent contractors who receive a 1099-NEC and not W-2s doesn't use the W-3 transmittal form. Can a W-3 form be submitted electronically?Yes, both the W-2 and W-3 forms can be filed electronically through the Business Services Online (BSO) provided by SSA. Simply put, employers should file Form W-3 Transmittal correctly and timely to prevent any unnecessary IRS penalties or complications. Fill Now

W-3 Transmittal Form When preparing your annual tax statements, there are a lot of documents employers have to deal with. For example, the W-3 transmittal of wage and tax statements is essential for every employer who extends Form W-2 to their employees. Let's delve into the practical aspects of this form, focusing particularly on various unusual circumstances, common mistakes, and FAQs. The W-3 Transmittal Form: Examples of Use In compliance with the IRS stipulations, a variety of situations and scenarios can necessitate the use of Form W-3 Transmittal. Putting it simply, if you're an employer and you have remunerated any employee during the year, the completion and submission of this form to the IRS become obligatory. Let's explore a few examples. Example 1: If you are an employer who employed a household worker such as a housekeeper, nanny, or gardener and compensated them over $2,300 during 2022, you are required to use this form Example 2: For small businesses that only utilize contract labor, remember that if this labor is under your control, similar to an employee, the IRS may classify this labor as an employee and not a contractor, requiring the use of the IRS W3 transmittal. Error Handling in Federal Form W-3 It's not uncommon for errors to occur during the submission process of Federal Form W-3 Transmittal. From minor numerical discrepancies to more serious infractions, such mistakes can cause significant delays in processing. Understanding how to correct these errors timely is pivotal. If, after the submission, an error is discovered on the Federal Form W-3 transmittal, make the necessary correction using Form W-2c, Corrected Wage and Tax Statement, and W-3c, Transmittal of Corrected Wage and Tax Statements. Do not complete a new W-3 form to correct an error. Popular W-3 Form-Related Questions Over my years of navigating legal and financial forums, I've encountered numerous questions on W-3 form transmittal. Here are three frequently asked questions. What is the due date for the W-3 transmittal form for 2022?The W-3 should be filed with the SSA by January 31, following the relevant calendar year. In which situations should an employer not file the IRS W3 transmittal?An employer who exclusively hires independent contractors who receive a 1099-NEC and not W-2s doesn't use the W-3 transmittal form. Can a W-3 form be submitted electronically?Yes, both the W-2 and W-3 forms can be filed electronically through the Business Services Online (BSO) provided by SSA. Simply put, employers should file Form W-3 Transmittal correctly and timely to prevent any unnecessary IRS penalties or complications. Fill Now -

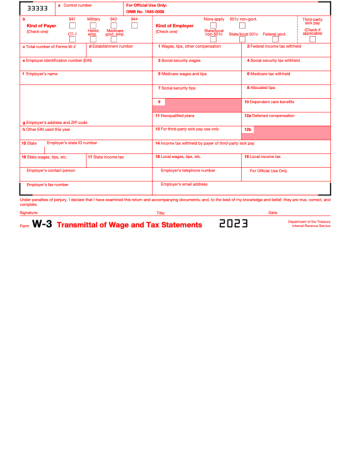

![image]() W3 Form Instructions Dealing with taxes can often be a complex and arduous task, especially when it involves understanding numerous forms and their specific requirements. One such form that often causes confusion and requires specific guidance is the IRS Form W-3. Understanding its purpose, utilization, and requirements is essential, especially when completing it for 2022. What is the Purpose of Form W3? The IRS Form W-3, also known as the Transmittal of Wage and Tax Statements, serves as a summary of all the W-2 forms that an employer submits. As a taxpayer, you might not interact directly with this form. However, it plays an essential role in the process of employers’ tax recording. In essence, it's the form that provides the Social Security Administration with a concise outline of all the W-2 Wage and Tax Statements that have been issued by a single employer in a tax year. Therefore, the instructions for Form W3 for 2022 mainly apply to employers. IRS Tax Form W-3 & Its Key Elements Employer Identification Number (EIN)This unique number assigned by the IRS is essential for the correct processing of the W-3. TotalsAll the totals in Form W-3 must match the corresponding totals on Form W-2. Business DetailsComplete and accurate details of the business, including name and address, are vital. SignatureIRS form W-3 must be signed and dated by the employer or an authorized business representative. Avoiding Common Mistakes in W3 Form Instructions Even with a basis of understanding the W3 form instructions, it’s not uncommon for individuals to make a series of easily avoidable errors when completing the paperwork. One of the most common mistakes is discrepancies in total amounts between the W-2 and W-3. Another recurring error is not properly filling in the employer's identification number and the business details. By strictly adhering to the provided W3 tax form instructions, these errors can be sidestepped. Federal Form W-3 Importance While the burden of filling out the Form W-3 usually falls on employers, as an employee, understanding Form W-3 helps you understand the tax process better, leading to more accurate individual tax returns. This awareness becomes increasingly important when handling your W-2 forms during the tax season. Having a detailed knowledge of the 2022 Form W-3 instructions clearly provides an edge. In the grand scheme of things, understanding and appropriately using the IRS Form W-3 ensures smoother tax processing and overall financial compliance for all parties involved. To conclude, while taxes may seem a daunting task, understanding all the rules and nuances, including the instructions for the W3 form, can make the process considerably less challenging. Continual learning and staying updated with revisions in forms and instructions play a vital role in compliant and efficient tax filing. Fill Now

W3 Form Instructions Dealing with taxes can often be a complex and arduous task, especially when it involves understanding numerous forms and their specific requirements. One such form that often causes confusion and requires specific guidance is the IRS Form W-3. Understanding its purpose, utilization, and requirements is essential, especially when completing it for 2022. What is the Purpose of Form W3? The IRS Form W-3, also known as the Transmittal of Wage and Tax Statements, serves as a summary of all the W-2 forms that an employer submits. As a taxpayer, you might not interact directly with this form. However, it plays an essential role in the process of employers’ tax recording. In essence, it's the form that provides the Social Security Administration with a concise outline of all the W-2 Wage and Tax Statements that have been issued by a single employer in a tax year. Therefore, the instructions for Form W3 for 2022 mainly apply to employers. IRS Tax Form W-3 & Its Key Elements Employer Identification Number (EIN)This unique number assigned by the IRS is essential for the correct processing of the W-3. TotalsAll the totals in Form W-3 must match the corresponding totals on Form W-2. Business DetailsComplete and accurate details of the business, including name and address, are vital. SignatureIRS form W-3 must be signed and dated by the employer or an authorized business representative. Avoiding Common Mistakes in W3 Form Instructions Even with a basis of understanding the W3 form instructions, it’s not uncommon for individuals to make a series of easily avoidable errors when completing the paperwork. One of the most common mistakes is discrepancies in total amounts between the W-2 and W-3. Another recurring error is not properly filling in the employer's identification number and the business details. By strictly adhering to the provided W3 tax form instructions, these errors can be sidestepped. Federal Form W-3 Importance While the burden of filling out the Form W-3 usually falls on employers, as an employee, understanding Form W-3 helps you understand the tax process better, leading to more accurate individual tax returns. This awareness becomes increasingly important when handling your W-2 forms during the tax season. Having a detailed knowledge of the 2022 Form W-3 instructions clearly provides an edge. In the grand scheme of things, understanding and appropriately using the IRS Form W-3 ensures smoother tax processing and overall financial compliance for all parties involved. To conclude, while taxes may seem a daunting task, understanding all the rules and nuances, including the instructions for the W3 form, can make the process considerably less challenging. Continual learning and staying updated with revisions in forms and instructions play a vital role in compliant and efficient tax filing. Fill Now -

![image]() W-3 Fillable Form The world is moving closer to a digital marketplace, and the realm of taxation is not lacking. This transition from paper-based to digital formats improves convenience, efficiency, and accuracy. The Internal Revenue Service (IRS) understands the necessity of this digital leap, leading to the development of electronic versions of their various forms. One such example is the IRS Form W3 fillable. IRS Form W3, also known as the Transmittal of Wage and Tax Statements, functions as a summary for all the W2 forms an employer issues. It compiles the total wages, social security, or other taxes withheld from employee's paychecks throughout the year. Previously, employers would have to mail these forms to the Social Security Administration physically. However, the introduction of the digital W-3 fillable form offers an alternative to the traditional method. Fillable W3 Form: Outlining its Characteristics The 2022 fillable W3 form is made for computer users boasting a few distinct attributes. Above all, its editable feature simplifies the form's completion process, allowing users to input data without the need for printouts or handwriting directly. This version also reduces the risk of common errors, such as illegible handwriting, allowing quicker, more efficient work. Another key feature of this form is its universal accessibility. The form can be filled out online from any device that has Adobe Acrobat Reader or a similar PDF editing application. Also, compact storage is another useful feature to consider. The fillable W3 form can be stored directly on your computer or in a cloud-based storage system, saving physical storage space. Fillable Online W-3: Addressing Potential Challenges Despite the clear benefits, using the fillable online W-3 form can still present a set of challenges, especially for the uninitiated users. For instance, there might be a compatibility issue with your device if it does not have the required software to access or edit PDF forms. Additionally, people who are not comfortable using digital technology might find the process more complicated than traditional paperwork. Another common challenge is related to internet connectivity. As the W3 form needs to be filled out online, a stable and secure internet connection is paramount. It would be frustrating to lose all the data inputted because of a sudden internet disconnection. Online security is also a crucial factor, as personal and sensitive information can be at risk of online theft or hacking. Fillable Form W-3 for 2023 Looking to the future, the 2023 Form W-3 fillable will continue to serve employers and improve the process of annual tax document submission. However, to leverage the benefits and overcome the challenges, proper guidelines must be in place. First, ensure you have the appropriate software installed on your device. If the form isn’t opening properly or you're having trouble filling it out, look into potential software compatibility issues. When filling out IRS forms online, treat them with the same level of seriousness as their physical counterparts. Take time to go over all the details and cross-check for any errors or discrepancies. Regularly save your work so you won’t lose your progress in case of internet disconnection. Lastly, always prioritize security. Make sure you work on a secure network and store the forms in a protected storage space. Taking these simple precautions can make your experience with digital tax form submission stress-free and efficient. Fill Now

W-3 Fillable Form The world is moving closer to a digital marketplace, and the realm of taxation is not lacking. This transition from paper-based to digital formats improves convenience, efficiency, and accuracy. The Internal Revenue Service (IRS) understands the necessity of this digital leap, leading to the development of electronic versions of their various forms. One such example is the IRS Form W3 fillable. IRS Form W3, also known as the Transmittal of Wage and Tax Statements, functions as a summary for all the W2 forms an employer issues. It compiles the total wages, social security, or other taxes withheld from employee's paychecks throughout the year. Previously, employers would have to mail these forms to the Social Security Administration physically. However, the introduction of the digital W-3 fillable form offers an alternative to the traditional method. Fillable W3 Form: Outlining its Characteristics The 2022 fillable W3 form is made for computer users boasting a few distinct attributes. Above all, its editable feature simplifies the form's completion process, allowing users to input data without the need for printouts or handwriting directly. This version also reduces the risk of common errors, such as illegible handwriting, allowing quicker, more efficient work. Another key feature of this form is its universal accessibility. The form can be filled out online from any device that has Adobe Acrobat Reader or a similar PDF editing application. Also, compact storage is another useful feature to consider. The fillable W3 form can be stored directly on your computer or in a cloud-based storage system, saving physical storage space. Fillable Online W-3: Addressing Potential Challenges Despite the clear benefits, using the fillable online W-3 form can still present a set of challenges, especially for the uninitiated users. For instance, there might be a compatibility issue with your device if it does not have the required software to access or edit PDF forms. Additionally, people who are not comfortable using digital technology might find the process more complicated than traditional paperwork. Another common challenge is related to internet connectivity. As the W3 form needs to be filled out online, a stable and secure internet connection is paramount. It would be frustrating to lose all the data inputted because of a sudden internet disconnection. Online security is also a crucial factor, as personal and sensitive information can be at risk of online theft or hacking. Fillable Form W-3 for 2023 Looking to the future, the 2023 Form W-3 fillable will continue to serve employers and improve the process of annual tax document submission. However, to leverage the benefits and overcome the challenges, proper guidelines must be in place. First, ensure you have the appropriate software installed on your device. If the form isn’t opening properly or you're having trouble filling it out, look into potential software compatibility issues. When filling out IRS forms online, treat them with the same level of seriousness as their physical counterparts. Take time to go over all the details and cross-check for any errors or discrepancies. Regularly save your work so you won’t lose your progress in case of internet disconnection. Lastly, always prioritize security. Make sure you work on a secure network and store the forms in a protected storage space. Taking these simple precautions can make your experience with digital tax form submission stress-free and efficient. Fill Now